From nature risk to business resilience.

The nature intelligence platform for forward-looking organisations.

The new reality.

Nature risks are financial risks.

Nature loss is no longer an abstract environmental issue: it’s a material financial risk.

The rapid degradation of ecosystems and biodiversity is exposing businesses to growing physical risks, driven by their dependencies on ecosystem services, and transition risks, driven by their impacts on nature. These risks are already affecting revenues, costs, asset values, and supply-chain resilience.

Climate hazards, water stress, deforestation controversies, soil degradation, loss of pollinators, regulatory backlash, market shifts, and reputational crises are no longer edge cases.

They are becoming systemic risk factors for companies and investors alike.

The problem.

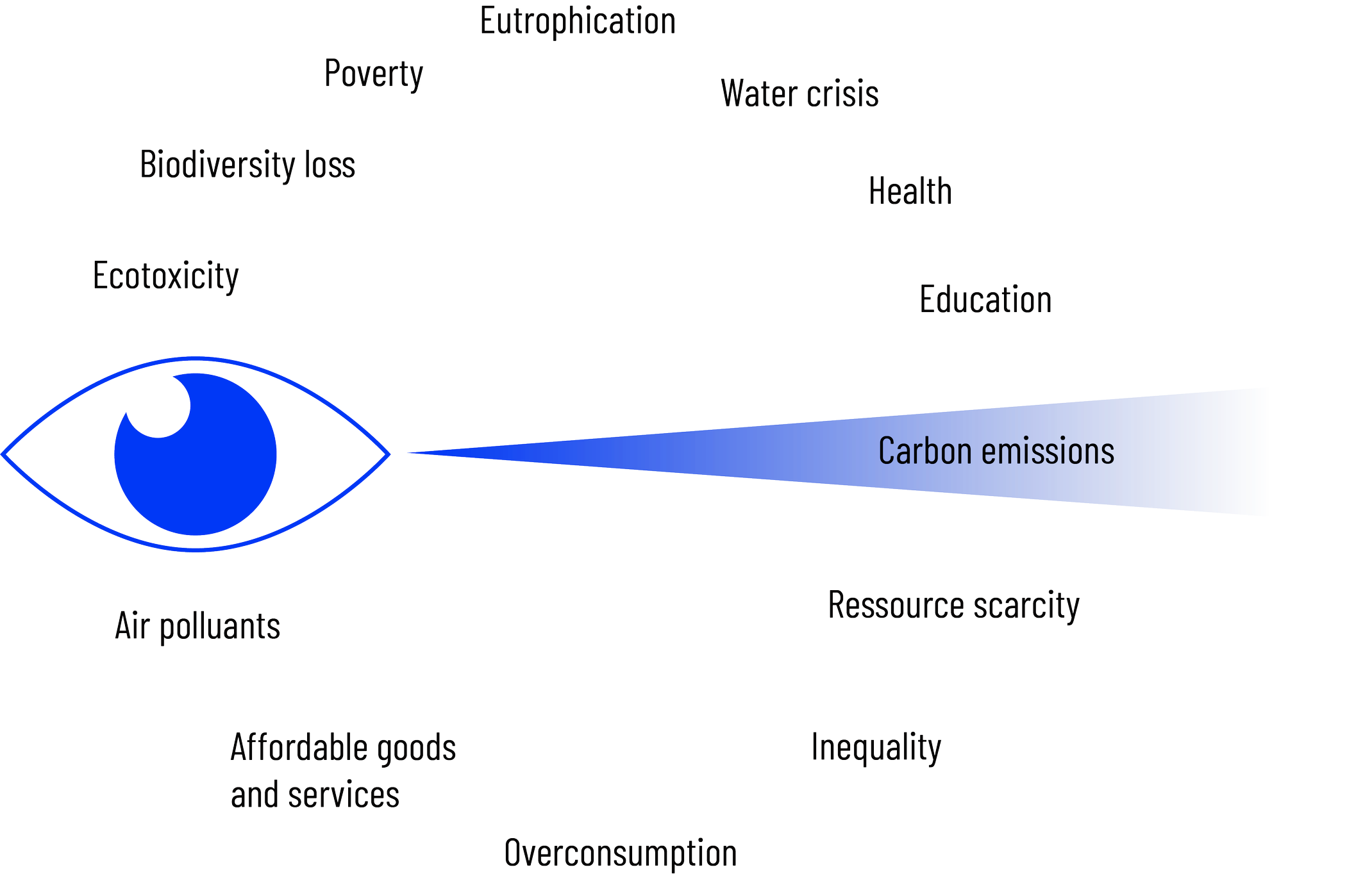

Nature-related risks remain invisible.

Environmental challenges are still too often addressed in isolation. Climate, biodiversity, water, and pollution are treated as separate crises, when in reality they are deeply interconnected and reinforce one another.

Historically, businesses have focused on measuring and reducing GHG emissions, while lacking a clear view of their exposure to broader nature-related risks. Critical pressures such as land-use change or resources overploitation are frequently overlooked — not because they are immaterial, but because companies often do not know where these risks sit across their operations and value chains.

This siloed approach creates blind spots and unintended trade-offs between environmental pressures. As a result, organizations struggle to prioritize action where it matters most

Our approach.

Integrated nature-risk intelligence, built for action.

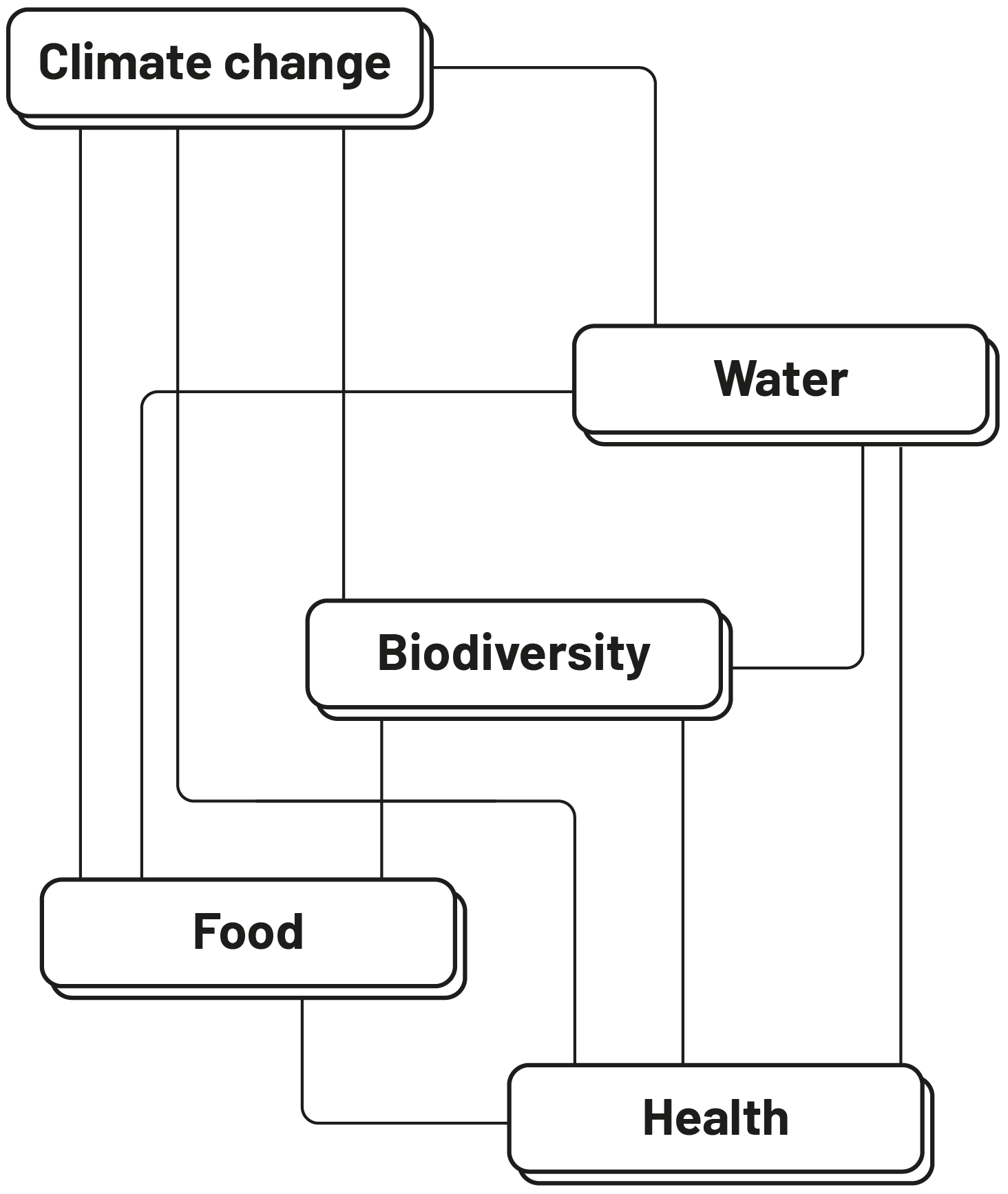

At Darwin, we start from a simple observation: nature, water, climate, food, and health are deeply intertwined. This is what the IPBES refers to as the “nexus.”

Our approach assesses impacts, dependencies & risks related to nature by embracing the full complexity of Earth systems. We rely on the IPBES framework of five key environmental pressures — the main drivers of change in nature — to move beyond single-issue analyses and deliver a truly integrated view of risk, not only on your operations but also within your value chain.

By breaking down environmental silos, Darwin enables organizations to make informed, consistent decisions across pressures, set meaningful targets, and translate risk insights into concrete, actionable strategies. The result: better risk management, fewer trade-offs, and a credible path toward a nature-positive economy.

Our platform leverages cutting-edge science & tech to support risk-informed nature strategy design.

Our product.

Our platform and API are highly flexible.

Our modules cover every stage of nature strategies, from data collection to footprinting, risks assessment, spatial analysis, target-setting, action planning, and reporting.

We leverage advanced technologies — Big Data, AI, and geospatial intelligence — to streamline the entire process and make it scalable.

Why choose Darwin.

-

Identify physical & transition risks related to nature & biodiversity.

Pinpoint top priority sites.

Quantify & mitigate financial risk exposure.

-

Identify top raw materials, flag high risks commodities & suppliers and improve traceability.

Improve supply chain resilience & resources efficiency.

-

Ground ESG claims in data and move beyond qualitative statements.

Align targets with measurable baselines to feed ESG reports and coms.

Showcase positive & avoided impacts (vs. business-as-usual scenario).

-

Streamline nature reporting (e.g. Corporate Sustainability Reporting Directive - CSRD or Taskforce on Nature-related Financial Disclosures - TNFD).

Meet biodiversity criteria in tenders and client requirements.

Optimise access to financing.